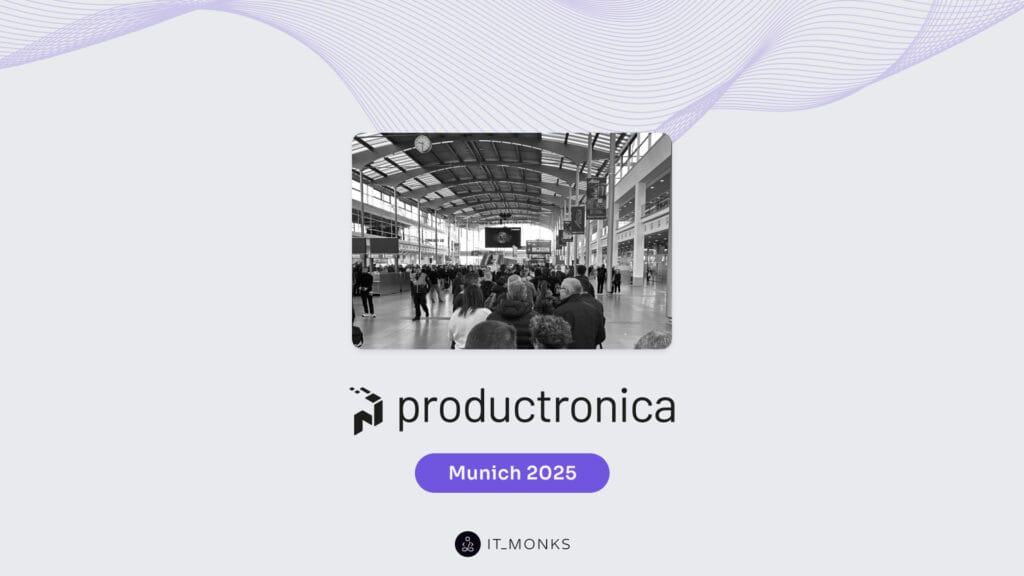

IT Monks at Productronica 2025

Table of Contents

At IT Monks, we don’t limit our presence to web-focused events. Understanding industry challenges requires meeting companies where their technology is built and demonstrated. This year, that meant joining the world’s leading trade fair for electronics manufacturing: Productronica 2025.

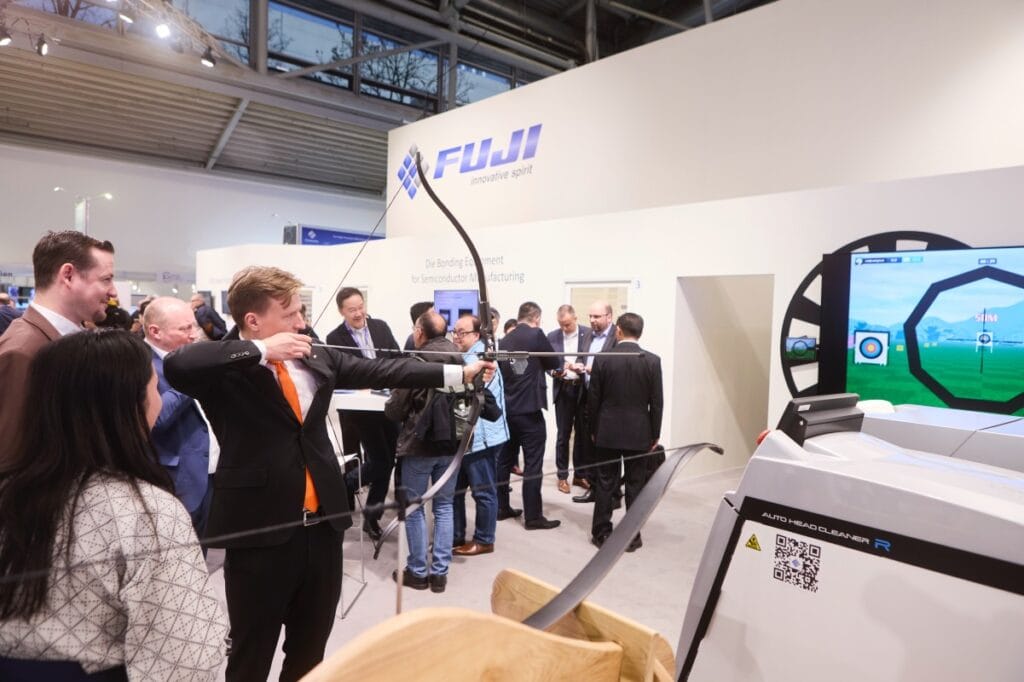

The exhibition has always been a showcase of advanced engineering, but this year’s edition pushed the boundaries even further. Between a full aircraft displayed inside a booth, a robotized dog navigating the aisles, and automated stations performing live motherboard diagnostics, innovation was everywhere you turned.

Over three days in Munich, we spoke with hundreds of teams whose factories operate with flawless precision while their digital systems struggle to keep up. Conversations repeatedly pointed to the same conclusion: industrial innovation no longer revolves solely around robotics or production efficiency. It increasingly depends on digital maturity.

Quick Recap

One thing became clear throughout the event: even though industries like automation, robotics, PCB production, and high-frequency testing run with incredible technical precision, their digital systems often don’t keep up. Many companies still see website speed, multilingual content, and proper lead tracking as nice-to-have extras instead of essential parts of how they do business globally.

This creates a real imbalance: factories that can easily scale their output, paired with digital platforms that can’t support that growth.

And no matter who we talked to (automation specialists, testing equipment manufacturers, or industrial software providers), the challenge was rarely the engineering. It was everything around it: the digital experience meant to show that expertise and turn it into actual opportunities.

Industry Conversations Insights

The conversations we had throughout Productronica reflected a shared understanding that future competitiveness depends on aligning factory-level precision with equally robust digital ecosystems.

Across companies of different sizes and specialties, leaders acknowledged that their next stage of growth will come from strengthening the digital infrastructure that supports international demand, technical communication, and scalable user journeys.

Below are several of the insights we gathered from these conversations.

Rohde & Schwarz: How AI is Reshaping Industrial Buying Behavior

Speaking with Merdan Elbistan offered insight into how the sector is rapidly adapting to AI-driven search behavior. Engineering teams now rely on advanced content formats, interactive documentation, and structured knowledge hubs long before they reach out to suppliers. Digital presence is part of the technical decision-making process.

Matthias Wetzel Industriebeschriftungen GmbH: Precision Beyond the Factory Floor

Even quick exchanges with teams like Matthias Wetzel Industriebeschriftungen reinforced a recurring theme: companies operating with extreme production precision increasingly expect the same level of quality from their digital ecosystem.

HAEFELY AG: Bridging Global Manufacturing and Digital Expectations

A discussion with Torsten Berth and Jon N. highlighted how manufacturers with a global footprint must align their digital strategy with international growth. Their experience illustrated how multilingual UX, regional performance, and CMS stability directly influence how brands are perceived in competitive markets.

Elektra Solar GmbH: Innovation in Demonstration and Engagement

Elektra Solar’s booth showcased how interactive demonstrations can turn complex engineering into intuitive experiences. Beyond that, the conversation focused on the digital support behind the physical demo: how users continue their journey after leaving the stand.

Schmoll Maschinen GmbH: Turning Technical Depth Into Digital Clarity

At the Schmoll Maschinen booth, the interactive demos highlighted a familiar challenge for industrial brands: presenting advanced technology online in a way that’s clear and easy to follow.

A good example is the Auto Line Shuttle (ALS), a driverless system that automatically moves PCBs between drilling machines. Operators load boards once at a central point, and the ALS handles the transport workflow, reducing manual work and downtime.

Since 2018, Schmoll Maschinen has been running in China and later in Germany and the U.S., shaping efficiency across both the DACH region and key Asian manufacturing markets.

How Speed and UX Impact Manufacturing Sales

One of the most striking insights across conversations was the strong correlation between digital performance and real revenue outcomes.

Manufacturers now recognize that slow websites, outdated UX, and poorly structured product information impact:

- RFQ volume

- distributor engagement

- regional lead quality

- customer trust

- international visibility

A manufacturer can dominate in engineering terms yet lose a potential customer before the first interaction if the digital experience fails to match the brand’s technical credibility.

The effect is even more pronounced in global markets, where multilingual navigation, local search behavior, and distributor workflows determine whether a prospect proceeds or disengages.

Next Steps for the Industry

In previous years, most conversations focused on automation and production upgrades. This time, the shift was clear: manufacturers are thinking about how to scale digitally.

There’s a growing understanding that growth can’t depend only on trade fairs, personal networks, and offline channels. The companies moving fastest will be the ones whose digital systems match the sophistication of their production lines.

This includes:

- websites that load in under two seconds,

- CMS platforms that allow quick, safe updates,

- multilingual user experiences designed for global distributors,

- fully connected analytics and lead-tracking,

- technical content that explains complex products clearly and builds trust.

Closing Thoughts

Productronica 2025 offered a clear view of where the manufacturing sector is heading. The automation is impressive. The engineering is exceptional. The innovation is unmistakable.

But the real competitive advantage in the coming years will belong to the companies that ensure their digital systems evolve at the same pace as their production technologies.

For many manufacturers, the question is no longer whether to modernize their digital ecosystem. The question is how fast modernization can begin.

Contact

Don't like forms?

Shoot us an email at [email protected]